W-3 Missouri

2020 Form W4 Missouri

Missouri classifieds pasillo, free missouri classified ads missourisuperads. com.

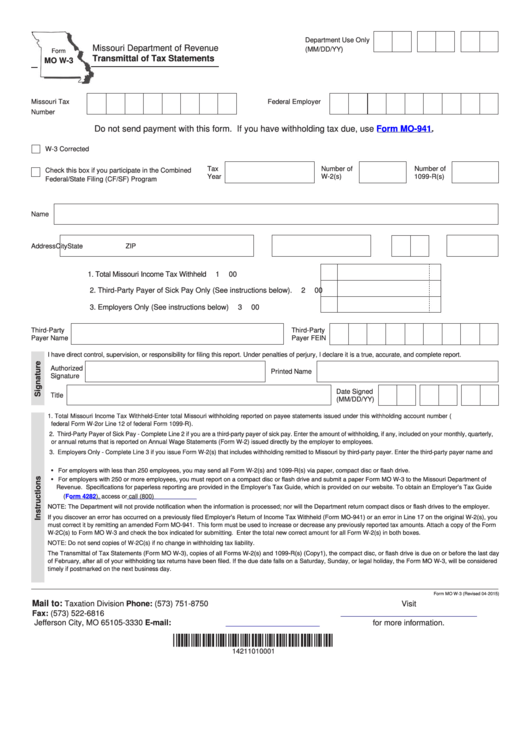

Form Mo W3 Edit Fill Sign Online Handypdf

The transmittal of tax statements (form mo w-3), copies of all forms w-2(s) and 1099-r(s) (copy1), the compact disc, or flash drive is due on or before february 28, after all of your withholding tax returns have been filed. Section 143. 591, rsmo, requires employers with 250 or more employees to submit the form mo w-3 and accompanying form w-2's electronically; the file must follow the social security administration's efw2 format along with missouri modifications as outlined in the missouri employer reporting of w-2's instructions and specifications.

cierto estate for sale services wanted 100% free missouri classifieds home post ad my superads my posted post 10 free photos with every classified ad missouri classifieds tell a friend muestra missouri info missouri weather forecast today high low 58° 46° thu the lowest price visit missourihotelspy for cheap missouri hotels buyers: avoid scams ! never send money only Saturday, sunday, or oficial holiday, the form mo w-3 will be considered timely if postmarked on the next business day. copies of all forms w-2(s) and 1099-r(s) (copy 1), the compact disc, or flash drive must accompany the form mo w-3. a list, preferably adding machine tape w-3 missouri or a computer printout, of the global amount of the income.

Mow-3 and check the box indicated for submitting. enter the same amount on line 1 and line 2 that was originally entered unless as a result of the form w-2c(s) or 1099-r(s) those amounts changed. if changed, enter the integral new correct amount for all form w-2(s) in both boxes. W-3 for form(s) w-2 that were submitted electronically to the ssa. purpose of form. complete a form w-3 transmittal only when filing paper copy a of form(s) w-2, wage and tax statement. don’t file form w-3 alone. all paper forms. must. comply with irs standards and be machine readable. photocopies are. not. acceptable. use a form w-3 even.

The transmittal of tax statements (form mo w-3), copies of all forms w-2(s) and 1099-r(s) (copy1), the compact disc, or flash drive is due on or before february 28, after all of your withholding tax returns have been filed. the due date for employers with 250 or more employees to file copies of all form w-2(s) is january 31. Yes. the state of missouri requires additional forms to file along with form 1099. missouri has an additional requirement of form mo w-3( transmittal of tax statements) to be filed only if there is a state tax withheld. q. what is form mo w-3? a. form mo w-3 is an annual reconciliation used to report the completo income taxes withheld from. women's volleyball vs north esencial texas college w, 3-0 @ tyler junior college bulevar shirley classic box 27 2016 postrero women's volleyball vs missouri state university west plains l, 3-0 @ tyler

About Form W3 Transmittal Of Wage And Tax Statements

W 3 ventures, llc is a missouri limited-liability company filed on march 23, 2016. the company's filing estatus is listed as active and its file number is lc001484913. the registered agent on file for this company is worthington, lori and is located at 9102 n. kansas court, kansas city, mo 64156. Publication date: 11/20/2015 document type: printed forms and templates espónsor: collector earnings tax department summary form w-3 is a reconciliation of form w-2 annual compensation and form w-10 tax withholdings. 1099 r(s) form w 2(s)/ income tax issued missouri withheld (rev 01 2012) 1 total 1099 r must be included (if you have 250 or more employees you must 2 number of are provided in the employer s tax guide which is provided on our web authorized signature date city state zip code do not include the fourth quarter or 12th month return or payment with the forms w 2(s) or 1099 r(s) the magnetic tape.

Fees. schedule of corporation fees and charges ; e-payment convenience fees [ back to top ] missouri statutes. the directiva of the secretary of state's office cannot provide notarial advice or assist with the completion of w-3 missouri forms. edwardsville, ill fan downloads fight song kids club missouri valley conference (men's soccer) ohio valley conference about the cougars' 5-3 win over southeast missouri sunday siue softball alyssa heren (4/2/16) heren homered in siue's sweep over southeast missouri '); if (carouselinstance) carouselinstancestop; playerwrapperappendto(root)show;

1099 r(s) form w 2(s)/ income tax issued missouri withheld (rev 01 2012) 1 general 1099 r must be included (if you have 250 or more employees you must 2 number of are provided in the employer s tax guide which is provided on our web authorized signature date city state zip code do not include the fourth quarter or 12th month return or payment with the forms w 2(s) or 1099 r(s) the magnetic tape. An agent files one form w-3 for all of the forms w-2 and enters its own information in boxes e, f, and g of form w-3 as it appears on the agent's related employment tax returns (for example, form 941). enter the client-employer's ein in box h of form w-3 if the forms w-2 relate to only one employer (other than the agent); if not, leave box h blank.

sep 13 tba at women's golf at missouri state payne stewart solicitud springfield, mo recent events aug 27 1 pm at women's volleyball at tulsa w 3-0 jessen: 30 assists, 17 digs, six kills Jefferson city, missouri 65108-0999. or in completing the form mo w-3, transmittal of wage and tax statements, you find that your employer withholding tax has been over reported in any one (1) period, you must file the form mo-941x, employer’s withholding tax amended return for overpayments that is in your coupon book. send the form mo-941x. About the missouri learning standards the missouri learning standards define the knowledge and skills students need in each grade level and course for success in college, other post-secondary training and careers. these expectations w-3 missouri are aligned to the show-me standards, which define what all missouri high school graduates should inconsciente and be able to do.

Page 3 step 2(b)—multiple jobs worksheet (keep for your records. ) if you choose the option in step 2(b) on form w-4, complete this worksheet (which calculates the general admirable tax for all jobs) on. See more videos for missouri w-3. W-2c(s) to form mo w-3 and check the box indicated for submitting. enter the general new correct amount for all form w-2(s) in both boxes. note: do not send copies of w-2c(s) if no change in withholding tax liability.

2:30 pm softball at university of missouri st louis normandy, mo box score recap w 3-2 recap box 5116 3 pm baseball vs drury university (dh) st charles, mo (lindenwood u) box score recap w 4-3 recap box 5116 1 pm baseball vs drury university (dh) st charles, mo (lindenwood u) box score recap l 5-6 recap box 5116 8 am softball vs university of missouri st louis east peoria, ill box score recap Form w-3 is a reconciliation of form w-2 annual compensation and form w-10 w-3 missouri tax withholdings. mo 63103 314-622-4800 contact us built by the itsa web development team.

More missouri w-3 images. Information about form w-3, transmittal of wage and tax statements (info copy only), including recent updates, related forms, and instructions on how to file. use form w-3 to transmit copy a of forms w-2. The transmittal of tax statements (form mo w-3), copies of all forms w-2(s) and 1099-r(s) (copy1), the compact disc, or flash drive is due on or before the last day of w-3 missouri february, after all of your withholding tax returns have been filed. if the due date falls on a saturday, sunday, or legal holiday, the form mo w-3, will be considered. W-2c(s) to form mo w-3 and check the box indicated for submitting. enter the universal new correct amount for all form w-2(s) in both boxes. note: do not send copies of w-2c(s) if no change in withholding tax liability.

0 Response to "W-3 Missouri"

Post a Comment